The Death of the Anonymous Customer in Automotive.

Why Australian automotive manufacturers still fail to recognise known customers — and why AI alone cannot fix it.

Where it breaks down

Automotive manufacturers and their dealer networks hold vast amounts of customer data, yet often behave as though they are meeting the same customer for the first time. This contradiction is widely recognised across OEM, dealer, and aftersales teams, although it is more often experienced as operational friction than treated as a strategic problem.

The gap matters because customer expectations have changed. In banking, telecommunications, and retail, continuity is assumed. Customers expect to be recognised across channels and over time. In automotive, fragmentation is still normalised by operating models rather than challenged by design. As revenue reliance shifts toward aftersales and retention, the cost of this disconnect becomes commercial, reputational, and increasingly regulatory (Federal Chamber of Automotive Industries, 2023).

What customers actually experience

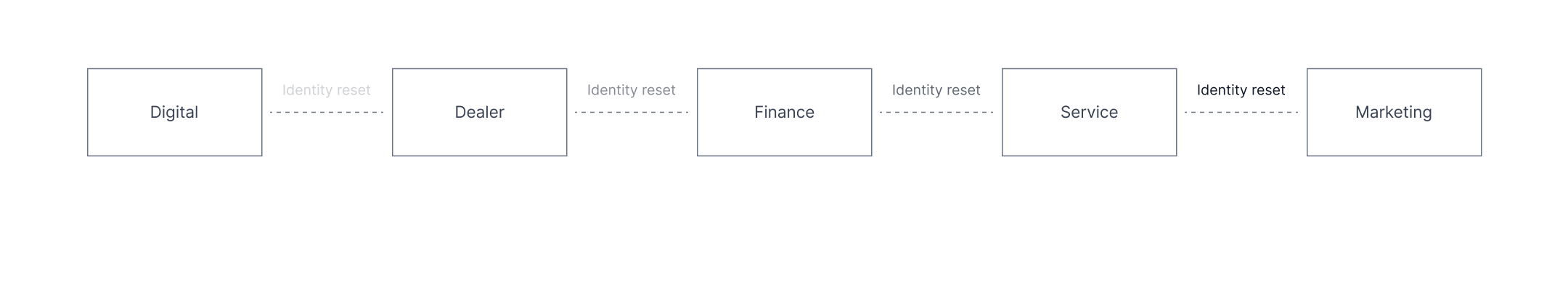

On an ordinary day, a known customer can move through the automotive ecosystem under several different identities. A digital enquiry captures intent, but that context rarely reaches the dealership. Sales teams re-qualify existing customers as new leads. Finance and insurance teams operate with limited visibility of earlier interactions. Service departments anchor records to vehicles rather than people.

From the customer’s perspective, this results in repetition, disjointed handovers, and communications that ignore ownership history. Internally, dealer teams and service staff rely on informal workarounds to bridge gaps between manufacturer platforms and local dealer systems, often reconciling data manually to compensate for structural misalignment.

These patterns are not edge cases. They are consistent behaviours shaped by franchise ownership models, legacy dealer management systems, and functional KPIs that reward transactions over relationships (Roy Morgan, 2022).

Identity continuity breaks between lifecycle stages

Why the usual fixes fall short

When these symptoms surface, the response is usually predictable. Manufacturers invest in a new CRM, introduce a customer data platform, or expand personalisation capability. The assumption is that the problem is technical.

In practice, identity fragmentation is rarely caused by a lack of tools. It persists because there is no clear ownership of customer identity across organisational boundaries. Platforms are introduced without shared accountability between manufacturers, importers, and dealers. The result is duplication rather than continuity.

This pattern continues because technology investment is visible and measurable, while responsibility for identity governance is diffuse. Manufacturers accumulate more data, but the question of who is responsible for remembering the customer as they move between systems remains unresolved.

Seeing the problem differently

AI has a role to play, but not as a solution in its own right. In automotive contexts, it works best as an enabling layer that helps reconcile identity across fragmented systems, supports decisions with historical context, and reduces the manual effort required to connect records.

These capabilities only make sense where consent, governance, and accountability are already clear. Automated identity inference without explicit permission introduces regulatory and trust risks, particularly in finance and service environments subject to heightened scrutiny (Australian Competition and Consumer Commission, 2022).

When AI is positioned as connective infrastructure rather than a centrepiece, the framing changes. The question shifts away from what technology is missing and toward who owns the customer across the lifecycle.

As identity moves through the system

Across the ownership lifecycle, identity fragmentation compounds rather than resolves itself. Acquisition systems focus on lead volume. Sales systems optimise for conversion. Service systems prioritise vehicle throughput. Marketing systems measure campaign performance.

Each system works well within its own remit, but none are accountable for continuity across stages. The lifecycle may appear connected in dashboards, yet it remains fragmented in lived experience.

Comparable markets such as the UK show that stronger standardisation can support cross-channel identity continuity. Differences in dealer autonomy, platform maturity, and regulatory structure limit direct transferability to Australia (UK Department for Transport, 2021). These examples illustrate what is possible, not what can be copied wholesale.

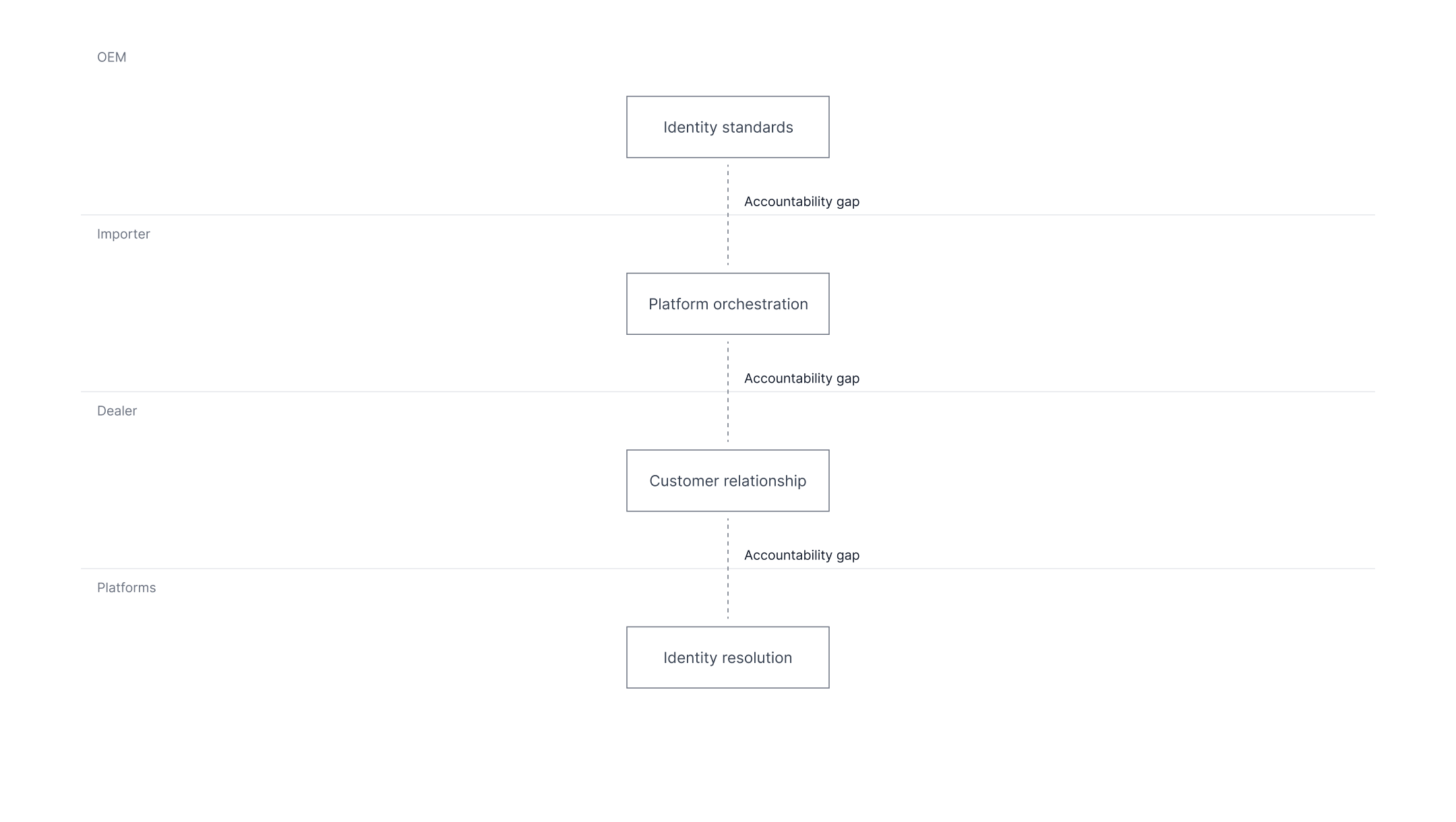

Where accountability gets unclear

Responsibility for customer understanding is widely distributed, but accountability is not. Automotive manufacturers define standards and governance. Importers orchestrate platforms and compliance. Dealers own local relationships. Service leaders manage ongoing interactions. Data and platform teams focus on integration and quality.

Breakdowns most often occur between manufacturer digital platforms and dealer operational systems, where incentives and authority diverge. Without explicit ownership of identity continuity, each party optimises within its own remit. Fragmentation is reinforced rather than resolved.

Accountability gaps across OEM, importer, dealer, and platform roles

What it leads to

The consequences extend well beyond inconvenience. Customers lose trust when brands fail to recognise established relationships. Retention declines, while acquisition costs rise as loyalty weakens (Carsales, 2023).

Brand perception suffers when disorganisation is interpreted as indifference. Regulatory exposure increases where consent is assumed rather than managed. Internally, teams grow sceptical of transformation initiatives that add complexity without addressing the underlying problem.

These outcomes are not inevitable, but they are common where identity remains unmanaged.

What remains unresolved

The automotive industry does not lack customer data. It lacks customer memory.

The anonymous customer is not a leftover from the past. It is a product of current structures, incentives, and governance choices. AI can assist in remembering, but it cannot decide what should be remembered or who is responsible for carrying that memory forward.